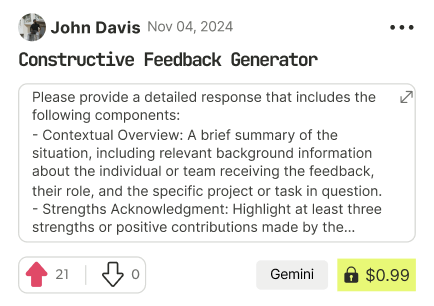

prompt mine App

Find, Create & Share AI Magic

Annuity Growth & Risks: 3 Drivers, 3 ETFs to Watch

Sure, here’s a clear breakdown focused on annuities:

Top 3 Growth Drivers for Annuities

1. Aging Population

As more people retire, the demand for reliable retirement income sources like annuities increases.

2. Market Volatility Concerns

During uncertain times, investors often seek safety and guaranteed income, driving interest in annuities.

3. Low Interest Rate Recovery

If interest rates rise from current levels, new annuity products can offer better payouts, attracting more buyers.

Top 3 Risks for Annuities

1. Interest Rate Sensitivity

Low or fluctuating rates can reduce annuity payouts and discourage new purchases.

2. Regulatory Changes

New rules or tax law adjustments can impact the appeal and flexibility of annuity products.

3. Insurer Credit Risk

The strength of the insurance company matters. If a provider faces trouble, payouts could be at risk.

3 ETFs/Stocks to Watch (Informational Only)

- BlackRock (BLK): World’s largest asset manager with exposure to retirement and insurance products.

- SPDR S&P Insurance ETF (KIE): Tracks a basket of insurance companies, including major annuity providers.

- Prudential Financial (PRU): A top insurer and a major provider of life insurance and annuities.

If you want detailed price data, trend snapshots, or performance comparisons on these stocks or ETFs, please provide your risk tolerance (conservative, balanced, or aggressive), and I’ll prepare a data-driven summary with tables and graphs.

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!