prompt mine App

Find, Create & Share AI Magic

Crafting a Balanced Monthly Budget for Savings and Enjoyment

Creating a monthly budget that allows you to save money while still enjoying small luxuries requires a thoughtful and structured approach. Here's a step-by-step guide to help you achieve this balance:

Step 1: Identify Your Income

Begin by calculating your total monthly income from all sources, including your salary, investments, and any side hustles.

Step 2: Categorize Your Expenses

Divide your expenses into the following categories:

1. Essentials (50-60% of your income):

Housing (rent/mortgage, utilities, insurance)

Food (groceries, dining out)

Transportation (car payment, insurance, gas, maintenance)

Minimum debt payments (credit cards, loans)

Insurance (health, life, disability)

2. Savings (10-20% of your income):

Emergency fund

Retirement savings

Other long-term savings goals (college fund, down payment on a house)

3. Entertainment (10-20% of your income):

Hobbies

Travel

Dining out

Movies, concerts, and other events

Subscriptions (streaming services, software, etc.)

4. Debt Repayment (5-10% of your income):

Paying off high-interest debt (credit cards, personal loans)

Step 3: Set Financial Goals

Determine what you want to achieve with your budget. Do you want to:

1. Build an emergency fund to cover 3-6 months of living expenses?

2. Pay off high-interest debt?

3. Save for a specific goal, like a down payment on a house or a vacation?

4. Increase your retirement savings?

Step 4: Assign Dollar Amounts

Based on your income, expenses, and financial goals, assign dollar amounts to each category. Be sure to prioritize your essentials, savings, and debt repayment.

Step 5: Track Your Expenses

Monitor your spending throughout the month to ensure you're staying within your budget. Use a budgeting app, spreadsheet, or simply keep track of your receipts.

Tips for Sticking to Your Plan:

1. Automate your savings: Set up automatic transfers from your checking account to your savings and investment accounts.

2. Use the 50/30/20 rule: Allocate 50% of your income towards essentials, 30% towards discretionary spending, and 20% towards savings and debt repayment.

3. Prioritize needs over wants: Be honest with yourself about what you need versus what you want.

4. Review and adjust: Regularly review your budget and make adjustments as needed to stay on track.

5. Avoid impulse purchases: Create a 30-day waiting period for non-essential purchases to help you avoid making impulsive decisions.

6. Celebrate milestones: Reward yourself for reaching your financial goals to stay motivated.

Sample Budget Breakdown:

Income: $4,000 per month

Essentials: $2,400 (60% of income)

+ Housing: $1,200

+ Food: $600

+ Transportation: $400

+ Minimum debt payments: $200

Savings: $800 (20% of income)

+ Emergency fund: $400

+ Retirement savings: $200

+ Other long-term savings goals: $200

Entertainment: $400 (10% of income)

+ Hobbies: $100

+ Travel: $100

+ Dining out: $100

+ Subscriptions: $100

Debt Repayment: $200 (5% of income)

+ Paying off high-interest debt: $200

Remember, this is just a sample breakdown, and you should adjust the categories and dollar amounts based on your individual needs and financial goals. By following these steps and tips, you can create a balanced monthly budget that allows you to save money while still enjoying small luxuries.

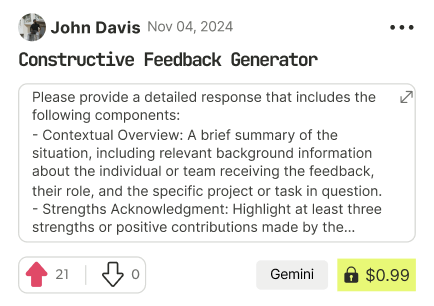

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!