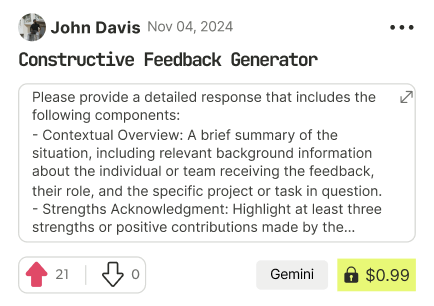

prompt mine App

Find, Create & Share AI Magic

Building an Emergency Fund Plan

Given the variables in your prompt, let's assign sample values to create a comprehensive plan. For this example, we'll use:

- Monthly income: $5,000

- Essential expenses: $3,500

- Target emergency fund amount: $15,000

Step 1: Assess Your Finances

- Calculate your monthly disposable income: $5,000 (monthly income) - $3,500 (essential expenses) = $1,500

- Allocate 50% to 70% of your disposable income towards saving and debt repayment. For this example, we'll use 60%: $1,500 x 0.6 = $900 per month

Step 2: Set a Realistic Savings Goal

- Aim to save 10% to 20% of your monthly income for the emergency fund. Based on our previous calculation, $900 per month is 18% of your income.

- Adjust your savings goal if needed, but for this example, we'll stick with $900 per month.

Step 3: Automate Your Savings

- Set up a separate savings account specifically for your emergency fund.

- Arrange automatic transfers from your primary checking account to your emergency fund account.

- Use the 50/30/20 rule as a guideline: 50% for essential expenses, 30% for discretionary spending, and 20% for saving and debt repayment.

Step 4: Cut Discretionary Spending

- Identify areas where you can reduce discretionary spending to allocate more funds towards your emergency fund.

- Consider implementing a "50/30/20" budgeting approach to prioritize needs over wants.

- Use the 30-day rule: wait 30 days before making non-essential purchases to ensure they're necessary.

Step 5: Explore Additional Income Sources

- Consider taking on a part-time job, freelancing, or starting a side hustle to increase your income.

- Sell unwanted items or assets to generate a one-time influx of funds for your emergency fund.

- Use tax-advantaged accounts, such as a high-yield savings account or a tax-free savings account, to optimize your savings.

Step 6: Track Your Progress

- Use a budgeting app like Mint, You Need a Budget (YNAB), or Personal Capital to track your expenses and savings.

- Set reminders and alerts to ensure you're meeting your monthly savings goals.

- Review your progress regularly to make adjustments as needed.

Timeline to Achieve Your Emergency Fund Goal

- Calculate the number of months it'll take to reach your target emergency fund amount: $15,000 / $900 per month = 16.67 months (approximately 1.39 years)

Tools and Apps to Track Your Progress

- Mint: A comprehensive budgeting app that tracks expenses, creates a budget, and sets financial goals.

- You Need a Budget (YNAB): A budgeting app that helps you manage your finances and stay on top of your expenses.

- Personal Capital: A financial management app that tracks your income and expenses, investments, and debts.

- Spreadsheets: Create a custom spreadsheet to track your progress, income, and expenses.

By following this plan, you'll be on track to build a substantial emergency fund in approximately 1.39 years. Remember to review and adjust your plan regularly to ensure you're meeting your goals and staying on track.

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!