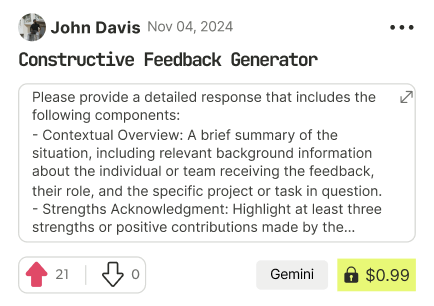

prompt mine App

Find, Create & Share AI Magic

Beginner's Guide to Navigating 10 Investment Strategies

As a seasoned financial advisor, I've compiled a comprehensive guide to help beginners navigate the world of investments. Below, you'll find explanations of 10 beginner-friendly investment strategies, including various types of investments such as stocks, bonds, mutual funds, and more.

1. Index Funds

Index funds allow you to invest in a diverse portfolio of stocks or bonds by tracking a specific market index, such as the S&P 500. This strategy offers broad diversification and can be less expensive than actively managed funds.

How it works: Invest in a fund that mirrors a specific market index.

Benefits: Diversification, low costs, and minimal effort required.

Risks: Market volatility and tracking errors.

Getting started: Choose a reputable index fund provider (e.g., Vanguard or BlackRock) and invest a small amount (e.g., $100) to start.

2. Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market's performance. This strategy helps reduce the impact of market volatility.

How it works: Invest a fixed amount of money at regular intervals (e.g., $100/month).

Benefits: Reduces market timing risks and encourages consistent investing.

Risks: May not perform well during rapidly rising markets.

Getting started: Set up an automatic investment plan with your bank or brokerage firm.

3. High-Yield Savings Accounts

High-yield savings accounts offer a safe and liquid place to store your money while earning a higher interest rate than traditional savings accounts.

How it works: Open a high-yield savings account and deposit your money.

Benefits: Liquidity, low risk, and a higher interest rate.

Risks: Inflation and interest rate changes.

Getting started: Research and open a high-yield savings account with a reputable online bank (e.g., Ally or Marcus).

4. Dividend-paying Stocks

Dividend-paying stocks offer a relatively stable source of income and the potential for long-term growth.

How it works: Invest in established companies with a history of paying consistent dividends.

Benefits: Regular income and potential for growth.

Risks: Market volatility, dividend cuts, and company performance.

Getting started: Research established companies with a history of paying consistent dividends (e.g., Johnson & Johnson or Coca-Cola).

5. Bonds

Bonds offer a relatively stable source of income with a fixed return, making them suitable for conservative investors.

How it works: Invest in a bond issued by a corporation or government entity.

Benefits: Regular income and relatively low risk.

Risks: Credit risk, interest rate changes, and inflation.

Getting started: Research and invest in high-quality bonds with a reputable brokerage firm.

6. Mutual Funds

Mutual funds offer a diversified portfolio of stocks, bonds, or other securities, managed by a professional investment manager.

How it works: Invest in a mutual fund that aligns with your investment goals and risk tolerance.

Benefits: Diversification, professional management, and economies of scale.

Risks: Management fees, market volatility, and style drift.

Getting started: Research and invest in a reputable mutual fund with a low expense ratio (e.g., Vanguard or Fidelity).

7. Exchange-Traded Funds (ETFs)

ETFs offer a diversified portfolio of stocks, bonds, or other securities, trading on an exchange like stocks.

How it works: Invest in an ETF that tracks a specific market index or sector.

Benefits: Flexibility, diversification, and transparency.

Risks: Trading costs, market volatility, and tracking errors.

Getting started: Research and invest in a reputable ETF with a low expense ratio (e.g., iShares or State Street).

8. Real Estate Investment Trusts (REITs)

REITs offer a way to invest in real estate without directly owning physical properties.

How it works: Invest in a REIT that owns or finances real estate properties.

Benefits: Diversification, income generation, and professional management.

Risks: Market volatility, property market fluctuations, and management fees.

Getting started: Research and invest in a reputable REIT with a strong track record (e.g., Realty Income or Simon Property Group).

9. Peer-to-Peer Lending

Peer-to-peer lending allows you to lend money to individuals or small businesses, earning interest on your investment.

How it works: Invest in a peer-to-peer lending platform (e.g., Lending Club or Prosper).

Benefits: Higher returns than traditional savings accounts and diversification.

Risks: Credit risk, borrower default, and platform risk.

Getting started: Research and invest in a reputable peer-to-peer lending platform.

10. Robo-Advisors

Robo-advisors offer automated investment management services at a lower cost than traditional financial advisors.

How it works: Invest in a robo-advisor platform that offers diversified investment portfolios.

Benefits: Low costs, convenience, and diversified portfolios.

Risks: Market volatility, algorithmic errors, and security risks.

Getting started: Research and invest in a reputable robo-advisor platform (e.g., Betterment or Wealthfront).

Remember, starting small and gradually building confidence in your investment choices is key. Always assess your personal financial goals, risk tolerance, and time horizon before investing.

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!