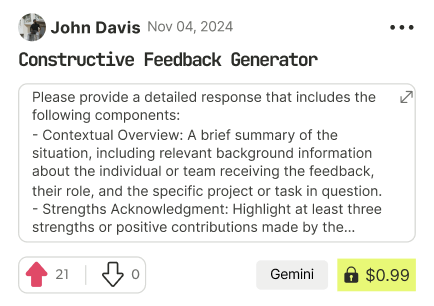

prompt mine App

Find, Create & Share AI Magic

Personalized Budget Planning: Strategies for Your Income and Location

Okay, let's create a personalized budget framework. To make this truly personalized, I need you to fill in the bracketed information:

* **[Income Level]:** Please tell me your net monthly income (after taxes and deductions). This is the most important piece of information.

* **[Location]:** Please provide your city and state (or general area). This will allow me to estimate costs for housing, transportation, and other location-dependent expenses.

Once you provide that information, I can build a more specific budget example. However, I'll also give you a starting point below and some general tips.

**Here's a general framework and guidance you can use *right now* to start building your budget:**

**I. Framework: A Starting Point (Adaptable to Your Income and Location)**

This uses a 50/30/20 rule as a guideline, but this is a *starting point*. You may need to adjust percentages based on your individual needs and priorities.

* **50% Needs:** Essential expenses.

* **30% Wants:** Discretionary spending.

* **20% Savings and Debt Repayment:** Building financial security.

Here's a table to organize your information. I'll fill it in with placeholder percentages and example expense areas. You should create your own version of this table in a spreadsheet or budgeting app and replace the numbers with your *actual* expenses.

| Category | Percentage (Example) | Estimated Amount (Based on hypothetical $4,000 Net Monthly Income) | Your Actual Amount | Notes/Details |

| --------------------- | --------------------- | --------------------------------------------------------------- | -------------------- | ----------------------------------------------------------------- |

| **Needs (50%)** | | $2,000 | | |

| Housing | 30% | $1,200 | | Rent/Mortgage, Property Taxes, Insurance (if homeowner) |

| Transportation | 7% | $280 | | Car payment, Insurance, Gas, Public Transportation, Maintenance |

| Food | 8% | $320 | | Groceries, Meal Prep, Occasional Eating Out |

| Utilities | 3% | $120 | | Electricity, Gas, Water, Trash, Internet |

| Healthcare | 2% | $80 | | Insurance Premiums, Co-pays, Prescriptions |

| **Wants (30%)** | | $1,200 | | |

| Entertainment | 8% | $320 | | Movies, Concerts, Hobbies, Subscriptions |

| Dining Out | 7% | $280 | | Restaurants, Coffee Shops |

| Travel/Vacation | 5% | $200 | | Planned trips, short getaways |

| Clothing/Shopping | 5% | $200 | | Non-essential clothing, impulse buys |

| Personal Care | 5% | $200 | | Haircuts, beauty products, gym memberships |

| **Savings/Debt (20%)** | | $800 | | |

| Emergency Fund | 10% | $400 | | Savings for unexpected expenses (aim for 3-6 months of expenses) |

| Debt Repayment | 5% | $200 | | Credit cards, student loans, etc. |

| Investments | 5% | $200 | | Retirement accounts, brokerage accounts |

**Important Considerations:**

* **Tracking is Key:** Use a budgeting app (Mint, YNAB, Personal Capital, etc.) or a spreadsheet to track your spending *for at least a month* before finalizing your budget. This will give you accurate data.

* **Be Realistic:** Don't set unrealistic restrictions. Small indulgences are okay. The goal is sustainable spending, not deprivation.

* **Regular Review:** Review your budget at least monthly. Life changes (job, relationship, unexpected expenses) require adjustments.

**II. Ways to Reduce Spending and Increase Savings**

* **Housing:**

* **Consider a smaller space or a roommate.**

* **Refinance your mortgage (if applicable) to a lower interest rate.**

* **Negotiate rent renewal (especially in a tenant-friendly market).**

* **Reduce energy consumption** (lower thermostat, unplug appliances when not in use, energy-efficient light bulbs).

* **Transportation:**

* **Use public transportation, bike, or walk whenever possible.**

* **Carpool.**

* **Maintain your vehicle to prevent costly repairs.**

* **Shop around for cheaper car insurance.**

* **If feasible, consider selling your car and using ride-sharing services occasionally.**

* **Food:**

* **Meal plan and cook at home more often.**

* **Reduce eating out.** Pack lunches.

* **Buy in bulk when appropriate.**

* **Use coupons and discount apps.**

* **Reduce food waste.**

* **Utilities:**

* **Conserve energy (as mentioned above).**

* **Shop around for cheaper internet and phone plans.**

* **Consider cutting cable TV or switching to a streaming service.**

* **Other Expenses:**

* **Review subscriptions and cancel those you don't use.**

* **Negotiate bills (credit cards, insurance).**

* **Find free or low-cost entertainment options (libraries, parks, community events).**

* **Avoid impulse purchases.** Wait 24-48 hours before buying non-essential items.

* **Increasing Savings:**

* **Automate your savings.** Set up automatic transfers to a savings account each month.

* **Take advantage of employer-sponsored retirement plans (especially if they offer matching contributions).**

* **Consider a side hustle to increase income.**

* **Use found money wisely.** Put tax refunds, bonuses, or unexpected income directly into savings or debt repayment.

**III. Financial Planning and Goal Setting**

* **Define Your Goals:** What do you want to achieve financially? (e.g., pay off debt, buy a home, retire early, travel, start a business). Be specific and set realistic timelines.

* **Prioritize Your Goals:** Rank your goals based on importance and urgency.

* **Create a Timeline:** Break down your long-term goals into smaller, manageable steps.

* **Track Your Progress:** Monitor your savings, investments, and debt repayment to see if you're on track.

* **Adjust Your Plan as Needed:** Life changes happen. Be flexible and willing to adjust your financial plan as necessary.

* **Seek Professional Advice:** Consider consulting with a financial advisor for personalized guidance, especially for complex financial situations. Fee-only advisors are often a good choice, as they don't receive commissions for selling products.

**Examples of Financial Goals:**

* **Short-Term (1-3 years):**

* Build an emergency fund (3-6 months of living expenses).

* Pay off high-interest debt (credit cards).

* Save for a down payment on a car.

* **Medium-Term (3-10 years):**

* Save for a down payment on a house.

* Pay off student loans.

* Save for a wedding.

* **Long-Term (10+ years):**

* Save for retirement.

* Save for children's education.

* Purchase investment properties.

**Key Financial Planning Principles:**

* **Compound Interest:** Understand the power of compound interest and start saving and investing early.

* **Diversification:** Spread your investments across different asset classes to reduce risk.

* **Tax Efficiency:** Take advantage of tax-advantaged savings accounts (e.g., 401(k), IRA, HSA).

* **Financial Literacy:** Continue learning about personal finance through books, articles, podcasts, and reputable websites.

**Next Steps:**

1. **Provide your net monthly income and location.** I can then provide a more specific budget example.

2. **Track your spending for at least one month.** This will give you accurate data for your budget.

3. **Create your own budget spreadsheet or use a budgeting app.**

4. **Set financial goals and track your progress.**

5. **Review and adjust your budget regularly.**

I'm ready to help you build a more detailed budget once you provide your income and location!

Personalized Budget Planning: Strategies for Your Income and Location

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!