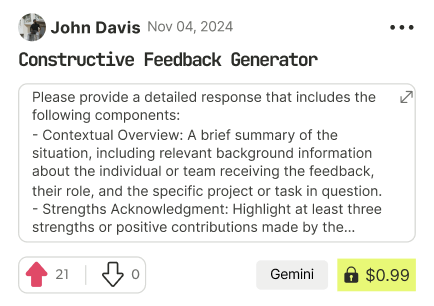

prompt mine App

Find, Create & Share AI Magic

Optimizing Personal Finances: A Comprehensive Spending Analysis and Savings Strategy

Since specific values are not provided for monthly income, expenses, and financial goals, a hypothetical scenario will be used to create a detailed, implementation-ready analysis. Please replace the hypothetical values with your actual financial information to make the suggestions more relevant.

Hypothetical Financial Scenario:

- Monthly income: $5,000

- Monthly expenses:

- Housing (rent/mortgage, utilities): $1,800

- Transportation (car loan/insurance, gas): $800

- Food (groceries, dining out): $800

- Insurance (health, life): $200

- Entertainment (hobbies, movies, travel): $500

- Debt repayment (credit cards, student loans): $800

- Savings: $200

- Miscellaneous (gifts, unexpected expenses): $100

- Short-term financial goals: Pay off high-interest credit card debt, build an emergency fund

- Long-term financial goals: Save for retirement, purchase a house

Identifying Areas of Overspending:

1. Dining out: Allocate 50% of the food budget ($400) for groceries and 30% ($240) for dining out. Reduce dining out expenses by $160.

2. Entertainment: Allocate 20% of the income ($1,000) for entertainment. Reduce entertainment expenses by $500.

3. Miscellaneous: Reduce miscellaneous expenses by $50.

Realistic Budget Adjustments:

1. Track expenses: Monitor expenses using a budgeting app (e.g., Mint, Personal Capital) or spreadsheet to identify areas of overspending.

2. Create a budget plan: Allocate 50% of the income for housing, utilities, and groceries. Use the 30/20/10 rule for the remaining 50%: 30% for non-essential expenses (entertainment, hobbies), 20% for debt repayment and savings, and 10% for unexpected expenses.

3. Reduce expenses: Implement cost-saving measures, such as canceling subscription services, cooking at home, and reducing transportation costs.

Money-Saving Strategies:

1. Groceries: Plan meals, use coupons, and buy in bulk to reduce grocery expenses by 10% ($80).

2. Utilities: Reduce energy consumption by 20% by using energy-efficient appliances and turning off lights when not in use.

3. Transportation: Carpool, use public transportation, or walk/bike to reduce transportation expenses by 10% ($80).

4. Entertainment: Find free or low-cost alternatives for entertainment, such as hiking, board games, or streaming services.

Prioritizing Expenses:

1. Essential expenses: Housing, utilities, groceries, insurance, and minimum debt payments.

2. Non-essential expenses: Entertainment, hobbies, and miscellaneous expenses.

3. Savings and debt repayment: Allocate 20% of the income for savings and debt repayment.

Long-term Financial Planning:

1. Emergency fund: Save 3-6 months' worth of expenses in an easily accessible savings account.

2. Retirement savings: Contribute at least 10% of the income to a retirement account (e.g., 401(k), IRA).

3. Debt management: Pay off high-interest debt, and consider consolidating debt into a lower-interest loan or credit card.

Specific Financial Challenges:

1. High-interest credit card debt: Consider balance transfer options or debt consolidation.

2. Limited savings: Automate savings by setting up automatic transfers from checking to savings accounts.

Preferred Tools or Resources:

1. Budgeting apps: Mint, Personal Capital, or YNAB (You Need a Budget)

2. Spreadsheets: Google Sheets or Microsoft Excel

3. Financial planning resources: The Balance, NerdWallet, or Dave Ramsey's website

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!