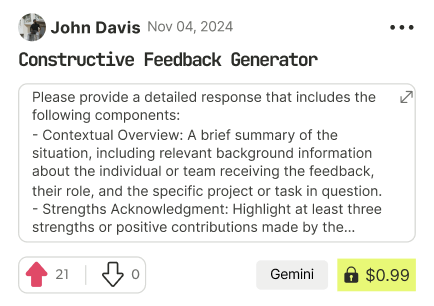

prompt mine App

Find, Create & Share AI Magic

QuantumMarket Navigator: Strategic Portfolio Resilience Analysis

I'll provide a comprehensive strategic framework addressing your portfolio positioning in the current inflationary environment, leveraging advanced analytical approaches.

<Market_Psychology>

Current behavioral patterns indicate heightened investor anxiety around inflation, driving emotional decision-making and potential overreaction. Cognitive biases like loss aversion and recency bias are significantly influencing market sentiment, creating potential mispricing opportunities.

Key Psychological Indicators:

- Increased risk sensitivity

- Growing distrust of traditional asset allocation models

- Heightened desire for "protective" positioning

</Market_Psychology>

<System_Dynamics>

Chaos theory analysis reveals non-linear interactions between monetary policy, technological disruption, and investment ecosystems. Current feedback loops suggest:

- Potential amplification of inflationary pressures

- Complex interdependencies between fiscal stimulus and market volatility

- Emerging adaptive mechanisms in investment strategies

</System_Dynamics>

<Asymmetric_Opportunities>

Potential mispriced risk/reward scenarios:

1. Sector rotation toward inflation-resistant industries

2. Alternative asset classes with structural hedging capabilities

3. Technology-enabled investment vehicles with adaptive mechanisms

4. Global diversification strategies leveraging geographical arbitrage

</Asymmetric_Opportunities>

<Tail_Risk_Assessment>

Potential Black Swan Scenario Considerations:

- Unexpected monetary policy shifts

- Technological disruption accelerating economic transformation

- Geopolitical realignments affecting global investment landscapes

- Climate-related economic discontinuities

Confidence Interval: Moderate uncertainty (60-70% probabilistic range)

</Tail_Risk_Assessment>

<Strategic_Positioning>

Recommended Adaptive Approaches:

1. Gradual portfolio rebalancing

2. Increased allocation to inflation-protected securities

3. Exploration of alternative asset classes

4. Maintain flexibility and optionality

5. Regular portfolio stress testing

Risk Management Principles:

- Preserve capital preservation

- Maintain diversification

- Stay adaptable to emerging economic signals

- Avoid reactive, emotion-driven decisions

</Strategic_Positioning>

CRITICAL DISCLAIMER: These insights represent probabilistic scenarios, not definitive predictions. Always consult professional financial advisors for personalized guidance tailored to your specific circumstances.

Recommended Next Steps:

- Conduct comprehensive portfolio stress test

- Review asset allocation quarterly

- Stay informed about macroeconomic shifts

- Maintain psychological discipline

Would you like me to elaborate on any specific aspect of this strategic analysis?

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!