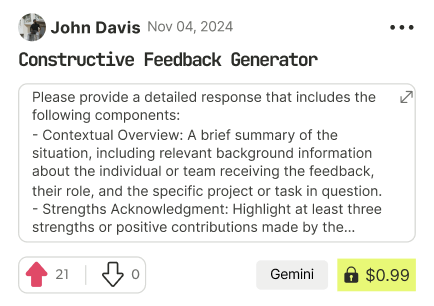

prompt mine App

Find, Create & Share AI Magic

Comprehensive Retirement Planning Guide

To create a comprehensive, step-by-step guide for planning a comfortable retirement, follow this detailed outline that covers key components such as setting realistic savings goals, exploring diversified investment options, and maximizing retirement income.

I. Introduction to Retirement Planning

Retirement planning is a crucial aspect of financial management that involves setting realistic goals, investing wisely, and maximizing income to ensure a secure and fulfilling retirement. This guide will walk you through a step-by-step process to achieve your retirement objectives.

II. Setting Realistic Savings Goals

1. Calculate Your Retirement Expenses: Estimate your monthly expenses during retirement, including housing, food, transportation, healthcare, and entertainment. Consider using the 50/30/20 rule as a guideline, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

2. Determine Your Retirement Savings Target: Use the following formula to estimate your retirement savings target:

- Retirement Savings Target = (Monthly Expenses x 12) / (Expected Annual Return on Investment x (1 - Tax Rate))

- Example: If your monthly expenses are $5,000, expected annual return on investment is 4%, and tax rate is 20%, your retirement savings target would be approximately $1.5 million.

3. Create a Savings Plan: Based on your retirement savings target, calculate how much you need to save each month to reach your goal. Consider using a retirement savings calculator or consulting with a financial advisor to get a personalized plan.

III. Investment Options for Retirement Funds

1. Low-Risk Investments: Consider the following low-risk investment options for your retirement funds:

- High-Yield Savings Accounts: 1.5% - 2.5% annual interest rate

- Certificates of Deposit (CDs): 2% - 4% annual interest rate

- U.S. Treasury Bonds: 2% - 4% annual interest rate

2. Moderate-Risk Investments: Explore the following moderate-risk investment options:

- Index Funds: 4% - 8% annual return

- Dividend-Paying Stocks: 4% - 8% annual return

- Real Estate Investment Trusts (REITs): 4% - 8% annual return

3. High-Risk Investments: If you have a high-risk tolerance, consider the following high-risk investment options:

- Individual Stocks: 8% - 12% annual return

- Cryptocurrencies: 10% - 20% annual return

- Private Equity: 10% - 20% annual return

IV. Strategies for Maximizing Retirement Income

1. Optimizing Social Security Benefits: Consider the following strategies to maximize your Social Security benefits:

- Delay claiming benefits until age 70 to increase monthly payments

- Claim spousal benefits if you're married

- Use the "Restricted Application" strategy to claim benefits on your spouse's record

2. Avoiding Taxes: Minimize taxes on your retirement income by:

- Using tax-deferred retirement accounts such as 401(k) or IRA

- Investing in tax-efficient investments such as index funds or municipal bonds

- Considering a Roth IRA conversion to reduce taxes in retirement

3. Exploring Alternative Sources of Income: Generate supplementary income in retirement by:

- Starting a part-time business or side hustle

- Renting out a spare room on Airbnb

- Investing in a real estate investment trust (REIT) or crowdfunding platform

V. Conclusion

Planning a comfortable retirement requires careful consideration of your savings goals, investment options, and income strategies. By following this comprehensive guide, you can create a personalized plan to achieve a secure and fulfilling retirement. Remember to review and adjust your plan regularly to ensure you're on track to meet your retirement objectives.

Find Powerful AI Prompts

Discover, create, and customize prompts with different models, from ChatGPT to Gemini in seconds

Simple Yet Powerful

Start with an idea and use expert prompts to bring your vision to life!